Welcome to our latest price forecast article! In this piece, we’ll share predictions for Lucid stock prices for the years 2024, 2025, 2030, 2040, and 2050. We hope you find this information valuable. If you enjoyed the article, please consider giving us a 5-star rating using the button at the top right corner of this post.

Lucid Motors is a pioneering electric vehicle company dedicated to transforming the transportation industry with its clean, energy-powered cars and trucks. Their years of research and development demonstrate a deep passion and unwavering commitment to this mission. Lucid Motors is well-positioned to spearhead automotive innovation in the future and usher “Cars into Tomorrow!” with the support of an exceptional team and vast potential.

Lucid Motors aspires to rival Tesla Motors and establish itself as a global leader in electric vehicles. The company aims to set a new standard for automobiles, striving to produce the best electric cars on the market with exceptional performance in every aspect. Available information suggests high expectations for Lucid’s future products. The company’s development is shrouded in mystery and secrecy, hinting at potentially groundbreaking innovations on the horizon.

Lucid Motors aims to maintain a transparent image, presenting itself as a car-focused company. Their designs are understated and elegant rather than flashy, which gives them a subtle yet sophisticated presence. From what I’ve observed, Lucid Motors’ strength lies in its disciplined and experienced management team, a quality that is often rare in the automotive industry.

Lucid Motors History

Lucid Motors was founded in 2007 by Bernard Tesla, who previously served as Vice President of Design and Product Development at Tesla. During his tenure at Tesla, he played a key role in the development of the Tesla Model S. With Lucid Motors, he aimed to introduce an innovative electric vehicle that would address the public’s concerns about the range limitations of battery electric vehicles.

Lucid Motors specializes in developing high-performance electric vehicles. The company builds on the Advanced Mobility Program Electric Dream (AMPED) initiative, started in 2009 by Peter Rawlinson, a former Tesla vice president. Harald Kroeger founded and funded Lucid Motors in 2013. By 2015, the company had begun production of its prototype model, the “LF1.”

The CEO of Lucid Motors is a renowned expert in battery development. His contributions include creating some of the most groundbreaking advancements in electrical engineering, such as the highly acclaimed electric motor assemblies, often compared to Rolls-Royce in their field, and securing several other patents in electrical engineering.

| Company Name | Lucid Motors |

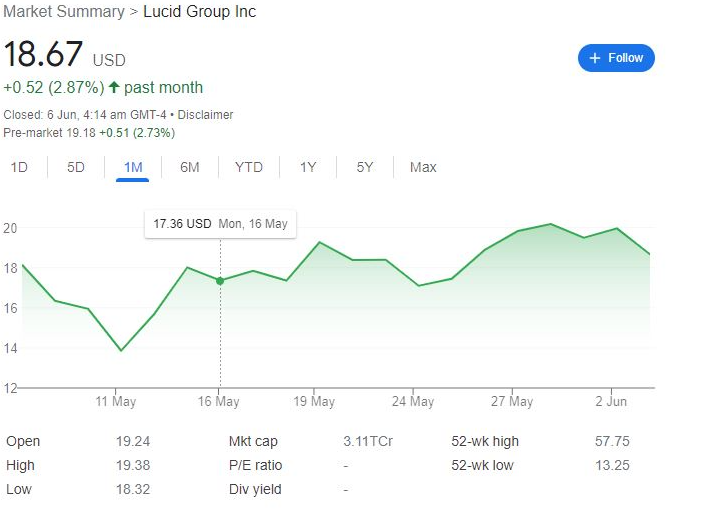

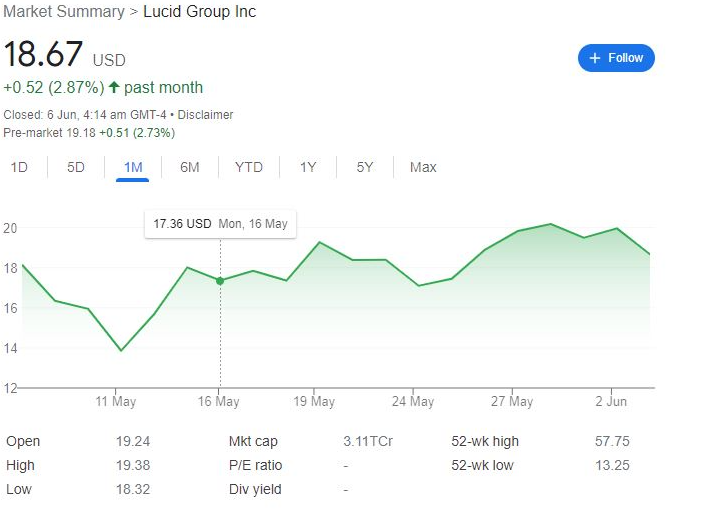

| Stock Price | US$18.67 |

| Founded | 2007 |

| Headquarters | Newark, California, United States |

| Number of Employees | 3900 |

| Revenue | $26.4 million |

| Founders | Bernard Tse, Sheaupyng Lin, Sam Weng |

Lucid Motors is a company that makes electric cars and energy storage systems. They also design and build parts for electric vehicles. The company used to be called Lucid Motors, Inc., but they changed their name to Lucid Motors Corp in August 2017. They are based in Menlo Park, California.

Lucid Motors Stock Price Analysis

Analysts are overall optimistic about Lucid’s stock price. Their earnings forecast is strong, at $24 billion or $18.67 per share. Lucid’s revenue has also been steadily growing for the past year. Based on this analysis and Lucid’s growing popularity, experts are bullish on the stock and expect its price to rebound soon. Overall, Lucid seems like a good investment opportunity. However, it’s important to consider other factors that can affect the stock price before making any investment decisions.

Lucid Motors Stock Price Prediction 2022 To 2050

| Lucid Price Prediction by Year | Minimum Price | Average Price | Maximum Price |

| 2022 | $18.20 | $32.68 | $48.70 |

| 2023 | $57.80 | $65.45 | $72.20 |

| 2024 | $74.65 | $79.30 | $82.50 |

| 2025 | $87.48 | $92.77 | $98.75 |

| 2026 | $108.90 | $109.78 | $119.78 |

| 2027 | $127.56 | $125.02 | $136.91 |

| 2028 | $148.74 | $146.96 | $165.00 |

| 2029 | $179.86 | $180.14 | $206.90 |

| 2030 | $229.98 | $228.60 | $256.78 |

| 2040 | $439.25 | $445.30 | $474.09 |

| 2050 | $798.80 | $816.65 | $887.24 |

Lucid (LCID) Stock Price Prediction For 2024, 2025, 2030, 2040, 2050 🥺🚗

Lucid Motors, a leading electric vehicle manufacturer known for its rapid growth, launched its first all-electric SUV, the LUCID, in 2020. Early analysts’ predictions were bullish, suggesting the stock price could reach $45 per share by 2023 and continue to climb thereafter.

Lucid (LCID) Stock Price Prediction 2022

| Year | Lucid Prediction Price |

| 2022 | $18.20 |

Analysts predicted the Lucid stock price to reach $18.20 in 2022. This forecast was based on an analyst’s estimate of future growth, painting a promising picture of the company’s future in the market.

However, it’s important to note that this forecast was for 2022 and the actual stock price may have differed.

Lucid (LCID) Stock Price Prediction 2023

| Year | Lucid Prediction Price |

| 2023 | $57.80 |

The Lucid Stock Price Prediction 2023 is an in-depth report that provides comprehensive and reliable information about the company, its products, and its services. This report draws upon the latest financial statements of Lucid Company, along with industry research reports and insights from equity analysts. Based on this research, it is projected that in 2023, the price of Lucid stock may rise to $57.82.

Lucid (LCID) Stock Price Prediction 2024

| Year | Lucid Prediction Price |

| 2024 | $74.65 |

The forecast for Lucid’s stock price is incredibly optimistic. We anticipate a hefty 20% increase in Lucid’s price within the next year, reaching approximately $74.65 by 2024. This suggests that Lucid’s stock is poised for a significant surge in the market, making it one of the most promising investments.

Lucid (LCID) Stock Price Prediction 2025

| Year | Lucid Prediction Price |

| 2025 | Around $120 |

The predicted rise in Lucid’s stock price for 2025 is estimated at 117.5%, reaching approximately $13.16. For 2026, the forecast suggests a price of around $87.48. Additionally, in 2026, the value of Lucid stock against the USD is expected to rise to $2.03, with a projected real value per share of $120.

Lucid (LCID) Stock Price Prediction 2026

| Year | Lucid Prediction Price |

| 2026 | $108.90 |

In 2026, experts predict that Lucid’s stock price will be $108.90. Lucid, Inc. stands out as the pioneer in providing a comprehensive solution for autonomous driving. From handling raw sensor data to training complex deep learning models on powerful GPU systems, Lucid offers an end-to-end solution tightly integrated into software deployment.

Lucid (LCID) Stock Price Prediction 2027

| Year | Lucid Prediction Price |

| 2027 | $127.56 |

Our analysis predicts the price of Lucid stock to reach $127.56 by 2027. That’s an estimated savings of 85.77% compared to the current price of $108.90. To make this prediction, we use an algorithm that considers past trading volumes, relevant events, and current market data to forecast the most likely future trading range for Lucid stock.

Lucid (LCID) Stock Price Prediction 2028

| Year | Lucid Prediction Price |

| 2028 | $148.74 |

Understanding the link between clarity and the current value of stocks is vital in finance. Sentiment, whether positive or negative, impacts not only stocks but also assets like Bitcoin, cryptocurrencies, and even real estate. This indicates an intense market condition, but if the trend persists, we can anticipate Lucid stock reaching $148.74 by the end of 2028. Let’s assess your portfolio’s health through diversified asset allocation.

Lucid (LCID) Stock Price Prediction 2029

| Year | Lucid Prediction Price |

| 2029 | $179.86 |

If you invest in Lucid stock now, it could hit its lowest point ever. Even if you purchase Lucid stock at its current price, I need to caution you that the stock price might keep dropping, possibly even reaching $0 or lower. But, if you manage to buy Lucid stock at $0, its worth could skyrocket to millions within a few years. To help you understand better, I’ve compiled a table showing optimistic, moderate, and pessimistic predictions for Lucid stock values in 2019 and 2029. Based on these projections, I estimate that Lucid stock could range between $179 and $206 per share by 2029.

Lucid (LCID) Stock Price Prediction 2030

| Year | Lucid Prediction Price |

| 2030 | Around $256 |

We estimate that the future stock price of Lucid will be $9.2, which represents a 0.74 times increase from its value in 2018. However, you have the freedom to invest in the company’s stock as you see fit and reap the benefits accordingly. If you’re averse to the risks associated with stock trading, you might consider investing in the company’s fund, which offers a consistent interest rate annually. Additionally, the company currently possesses income-generating assets and plans to expand further, which should lead to healthy profits for its investors. It’s reasonable to anticipate that the stock could reach $256 by the year 2030.

Lucid (LCID) Stock Price Prediction 2040

| Year | Lucid Prediction Price |

| 2040 | $440 |

Taking into account things like how advanced the technology is, how much people want to buy it, and how many other companies are in the same market, we’ve figured that by 2040, LUCD stock could be worth a lot, around $440. If you reckon Lucid’s stock is priced right now, then just hang onto what you’ve got. But if you think it’s worth more than it’s being sold for, maybe think about buying some. But really, the information we have is all over the place, so it’s hard to say for sure what’ll happen. Lucid might keep growing like crazy, or it might hit some bumps in the road—we just can’t say.

Lucid (LCID) Stock Price Prediction 2050

| Year | Lucid Prediction Price |

| 2050 | Around $800 |

The Lucid stock was valued at $11.88 back in 2017, with its peak reaching $8 in 2010. Considering these trends, it’s anticipated that by October 2050, the Lucid stock price could potentially reach around $800.

What is Lucid Motors a long-term stock?

Short-term vs. Long-term View:

While we’re cautious about Lucid’s stock price in the immediate future (bearish), we’re very optimistic about its long-term potential (bullish).

Financial Strength:

Lucid boasts a healthy balance sheet with significant cash reserves and no debt. This financial strength will be crucial for them to expand and innovate in the competitive self-driving car industry.

Societal Impact:

We admire Lucid’s commitment to social good. Their focus ranges from improving road safety and reducing traffic congestion to environmental benefits through pollution reduction.

Competitive Landscape:

Lucid faces stiff competition from established players like Alphabet (GOOGL), Tesla (TSLA), Ford, General Motors (GM), ride-sharing giants Uber and Lyft, and many others who already have a strong hold on investor attention.

Lucid’s Advantages:

Despite the competition, Lucid stands out with its impressive technology, dedicated leadership team, proven track record of success, and visionary approach to the future of transportation. These factors position them well to become an industry leader.

Frequently Asked Questions: Lucid (LCID) Stock Price Prediction

What will the value of Lucid stock be in 5 years?

Given Lucid’s rapid growth trajectory, we anticipate that its stock price could potentially reach approximately $127 within the next five years.

In 10 years, how much will Lucid stock be worth?

Our prediction suggests that Lucid’s stock will likely be worth around $315 per share in 10 years.

Is Lucid Stock Going to Be Like Tesla?

No, Lucid won’t be comparable to Tesla because Tesla is a more established company. It’ll be tough for Lucid to surpass Tesla in terms of car sales volume.

What is the LCID Price Target?

Analysts predict that LCID’s price could reach $3.03, with a potential high of $4.00 and a low of $1.75. Monitor the Lucid Group, Inc. stock chart over the next year to see if these predictions pan out. Stay updated on LCID news and overall stock market trends in the meantime.

Lucid Motor Car Production Prediction

| Car Model | Shipments 2025 | Shipments 2026 |

| Air | 42000 | 42000 |

| Gravity | 86000 | 134000 |

| New Model | 7,000-8,000 | 75000 |

| Total Shipments | 135000 | 251000 |

| Target Revenue | $14.0 Billion | $22.8 Billion |

Conclusion

Lucid Motors’ predictions for their stock prices can give investors a good idea of what to expect in the electric vehicle (EV) industry. By looking at the company’s finances and where the industry is heading, these forecasts paint a detailed picture of how Lucid might do in the future. If you’re unsure about anything or have questions, don’t hesitate to contact MoneyJack They’re here to assist you whenever you need it!