KEY POINTS

- PDD Holdings, Pandodo’s parent firm, owns Temu.

- Due to its low cost, the discount e-commerce business is expanding rapidly worldwide.

- Colin Huang, still PDD’s major shareholder, started the company.

If you shop online, Temu is a fast-growing online marketplace you’ve undoubtedly heard of. However, most Americans don’t know who owns Temu. PDD Holdings (PDD -0.19%), the parent firm of Temu, is one of the largest e-commerce businesses in China. It has used a similar strategy with Temu as it did with its flagship Chinese business, Pindodo.

A competitor to Shein and Amazon (AMZN 1.6%), it has expanded rapidly by offering a larger selection of lower-priced products in key foreign markets, such as the U.S. It has aggressively advertised to increase interest in its product line and brand awareness. uses

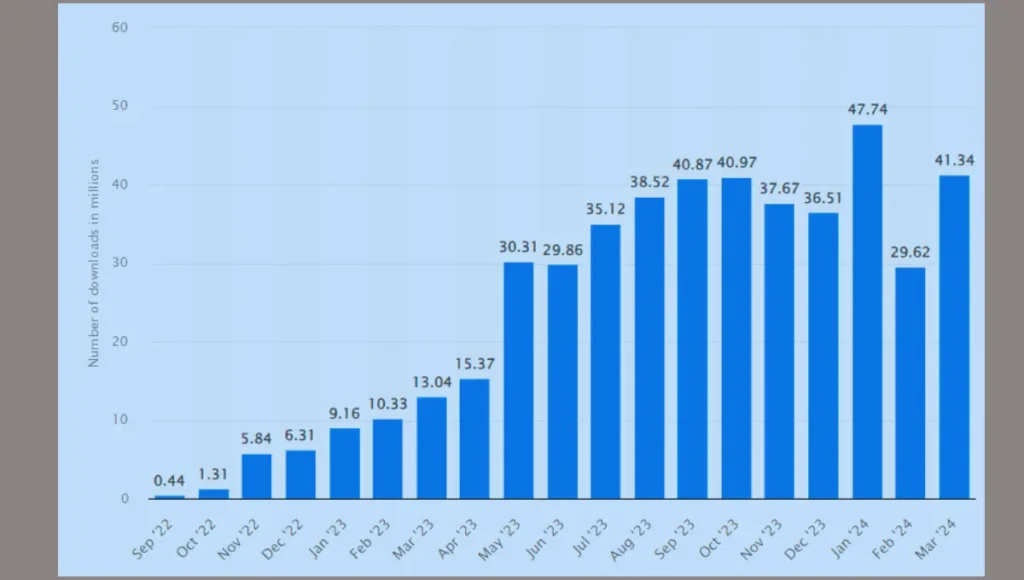

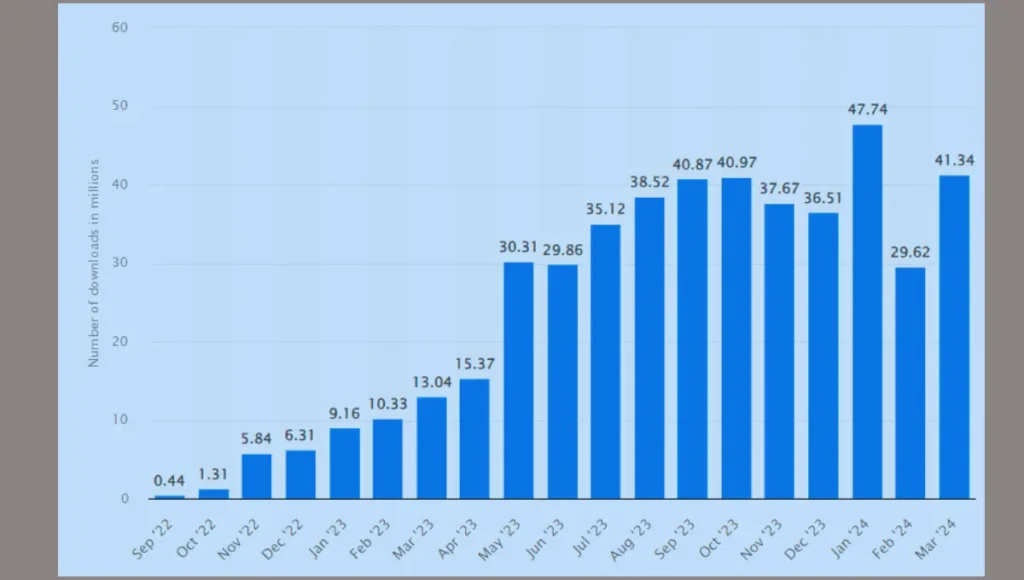

Although Temu was only introduced in September 2022, consumers, competitors, and even the online advertising sector — where Temu invests heavily in digital advertising — are already aware of its existence. Temu doesn’t disclose its revenue, but according to SimilarWeb, its traffic grew more than 700% in 2023, and in March of that year, its app surpassed TikTok as the most downloaded app in the United States.

Who is the owner of Temu?

| Category | Details |

| Main Business | Pinduoduo (PDD Holdings), owner of Temu |

| Founded | 2015 |

| Market Position | Competing with Alibaba (BABA) and JD.com (JD) for top spot in China’s e-commerce market, |

| Growth Strategy | Low prices and social commerce concepts |

| Temu Launch | September 2022, in the US |

| Global Expansion of Temu | Expanded to several nations in Africa, Latin America, and Europe |

| Projected Global Presence | Operating in more than 50 countries by May 2024 |

PDD Holdings, Pandodo’s main business, owns Temu. Due to its low prices and social commerce concept, similar to Groupon (GRPN 1.36%), Pinduoduo is a Chinese e-commerce company that has experienced significant growth in China.

Pinduoduo was founded in 2015, making it smaller than China’s two largest e-commerce companies, Alibaba (BABA -0.92%) and JD.com (JD -2.02%). However, it has rapidly increased its market share, competing with the other two for the top spot in the world’s largest online retail market for e-commerce.

PDD launched Temu in the US in September 2022, the company’s first major global release. Since then, Temu has expanded to several nations in Africa, Latin America, and Europe. It will be operating in more than 50 countries by May 2024.

Who are the largest shareholders?

| Category | Stockholder | Shares Owned | Percentage Ownership | Notes |

| Individuals | Zheng Huang (Colin Huang) | 1.41 billion | 25.4% | Co-founder and former CEO of PDD Holdings. Left official roles but is still a major shareholder. |

| Executive Officers and Directors | 62.2 million | 1.1% | Group of nine executive officers and directors. | |

| Institutional Shareholders | Tencent (TCEHY) | 783.5 million | 14.1% | Major Chinese tech company, investor, and strategic partner of PDD Holdings. |

| PDD Partners | 370.8 million | 6.7% | Subsidiary controlled by Colin Huang, based in the Virgin Islands. | |

| Bailey Gifford | 34.8 million ADS | 2.5% | Scottish investment management company. | |

| BlackRock (BLK) | 28.1 million | 2% | A global investment manager with stakes through mutual funds and ETFs. | |

| Vanguard Group | 24.3 million ADS | 1.8% | Major investment manager with stakes through mutual funds and ETFs. |

As Temu is a PDD Holdings subsidiary, Temu has no direct stockholders. However, PDD has a variety of stockholders, including private and institutional investors, because it is a publicly traded firm. Let’s examine the major stockholders of PDD Holdings.

Individuals

As of February 29, 2024, only one person was designated as the primary shareholder, according to the company’s annual report.

Zheng Huang, 1.41 billion shares, 25.4% ownership

Zheng Huang, aka Colin Huang, was the co-founder and former CEO of PDD Holdings. Huang, now a billionaire, was a member of the group that introduced Alphabet (GOOG 1.441.89%) to the Chinese market. Additionally, he envisioned Pinduoduo as a hybrid of Walt Disney’s (DIS 0.42%) Disneyland and Costco’s (COST -1.64%), a marketplace that provided both enjoyable experiences and great deals. Huang was CEO of PDD until July 2020, having founded the company in 2015 (then called Pinduoduo) and served as its leader for five years. The following year, he resigned as chairman, leaving him with no official role within the organization. He is currently conducting research in the areas of food and life sciences, potentially expanding Pinduoduo’s innovative approach to food delivery.

Additionally, according to PDD, its group of nine executive officers and directors controls a total of 62.2 million shares of the company’s stock, or 1.1% of all outstanding shares.

Institutional shareholders

In its annual report, Pinduoduo names two institutional shareholders. Nevertheless, other websites mention additional investors. The top five institutional shareholders of the corporation are listed below.

Tencent has 783.5 million shares, 14.1% of shares outstanding

Tencent (TCEHY -1.12%), the parent company of the popular Chinese app WeChat, is a well-known investor with several startups and publicly traded businesses, including e-commerce giant C Ltd (SE -0.76%) And it also has major stakes in JD.com, Temu, and PDD Holdings.

PDD also refers to it as a partner, stating that it trades through WeChat and WeChat Pay. Since 2017, Haifeng Lin, CEO of Tencent, has also served on the PDD Board of Directors. Tencent became a major stakeholder in the company in 2017, ahead of PDD’s 2018 initial public offering (IPO) in the United States. PDD and Tencent signed a strategic cooperation agreement in February 2018.

PDD Partners, with 370.8 million shares outstanding, or 6.7% of all shares;

PDD Holdings lists PDD Partners as institutional shareholders. After all, Colin Huang, the sole director of the two companies, of which PDD Partners is a subsidiary, ultimately controls the organization. A limited liability holding company based in the Virgin Islands is in charge.

34.8 million American Depositary Shares (ADS), or 2.5% of all outstanding shares, are owned by Bailey Gifford.

PDD is owned by Scottish investment management company Bailey Gifford through its global long-term global growth fund.

BlackRock, 28.1 million shares outstanding, or 2% of the total;

One of the largest global investment managers, BlackRock (BLK 0.61%), operates several exchange-traded funds (ETFs) under the name iShares. Through mutual funds and exchange-traded funds, it owns PDD Holdings, currently one of China’s largest tech stocks.

Vanguard Group has 24.3 million shares outstanding, or 1.8% of ADSs.

Another major investment manager, Vanguard Group, has stakes in PDD in both its mutual funds and exchange-traded funds.

Who is on Temu’s Board of Directors?

Temu has no board of directors. Temu is managed by the board of PDD Holdings, a subsidiary of PDD. PDD’s board of directors consists of six members, while its three non-board key executive officers are:

- Lei Chen, chairman: As a founding member of the corporation, Chen has served as co-CEO since April 2023 and chairman since March 2021. Before that, he served as its Chief Technology Officer and CEO from July 2020 to April 2023.

- Co-CEO and Director, Jiazhen Zhao: Zhao, a founding member of the company, has been co-CEO since April 2023. From 2018 to 2023, he served as senior vice president. In addition to founding the Duo Duo grocery segment, Zhao handled operations in the company’s flagship agriculture division.

- Anthony Kam Ping Leung, independent director since 2019: Apart from serving as Chairman of the Pay Committee and Chairman of the Audit Committee since 2019, Kam is an independent director. Kam has worked in Asia’s financial services sector for over thirty years, most recently as Deputy CEO of HSBC Bank (HSBC = 1.81%).

- Haifeng Lin, Director, in office since 2017: Lin has held the positions of Corporate Vice President at Tencent Holdings and CEO at Tencent Financial Technologies.

- Ivonne M.C.M. Rietjens, independent director since 2023: Rietjens is a member of the Corporate Governance, Audit, and Nominating Committees. She serves on the boards of several food science organizations and has over 25 years of experience in food safety.

- George Yong-Boon Yeo, independent director since 2018: Yeo has chaired the corporate governance and nomination committees and served as an independent director. He worked for the Singapore government for 23 years, including as Minister of Foreign Affairs, Trade and Industry, Health, Information and the Arts.

- Jun Liu, Vice President of Finance: Liu worked for the corporation as director of finance from 2017 to 2021 before being promoted to vice president of finance in 2022.

- Junyun Xiao, senior vice president of operations: Xiao is not only one of the founding members of PDD, but also its operations chief since 2018. In addition, he served as a director from April to July 2018.

- Zhenwei Zheng, Senior Vice President of Product Development: Zeng has served as Senior Vice President of Product Development since 2016 and is a founding member of PDD. Like Xiao, Zheng previously worked for the massive Chinese internet search company Baidu (BIDU, U -0.25%) and served as a board member for a brief period in 2018.

How to invest in Temu

| Category | Details |

| Direct Investment in Temu | Not open to direct investment. |

| PDD Holdings Investment | Publicly traded on the Nasdaq stock exchange under the ticker symbol PDD. |

| How to Buy PDD Stock | Use a brokerage platform, search for the ticker PDD, and select the buy option. |

| Temu’s Financial Reporting | Results are not broken down individually by PDD. |

| Impact of Temu on PDD | Helped PDD expand rapidly since its inception. |

| PDD Revenue Growth (2023) | Revenue more than doubled in Q4 2023 and increased in each of the next four quarters of 2023. |

| Future Financial Information | PDD may provide additional information about Temu, such as earnings, as it expands. |

| Investment Potential | Investors interested in Temu should buy PDD for exposure to Pindodo’s growth. |

| PDD’s Performance | I have seen explosive growth on both the top and bottom lines. |

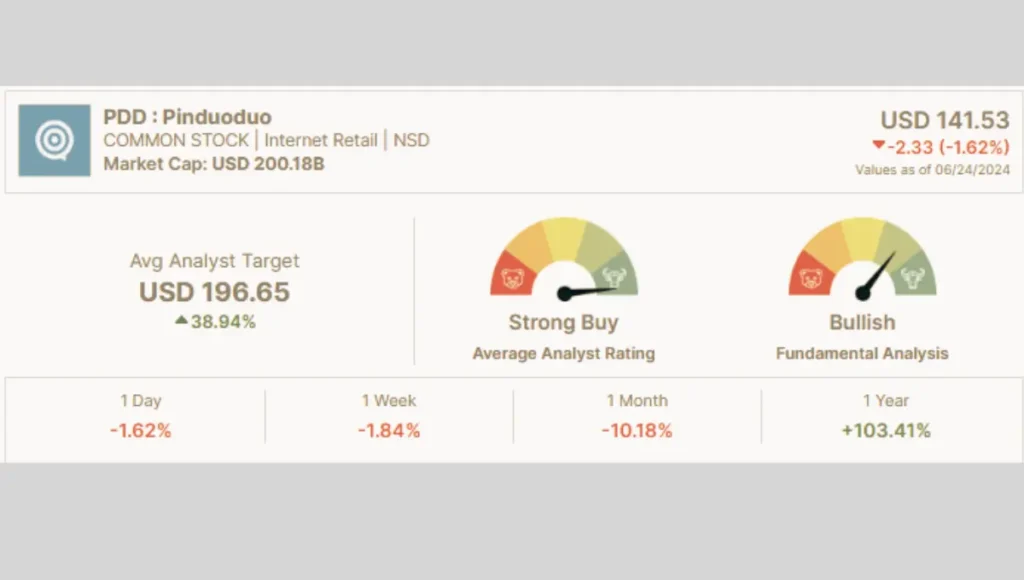

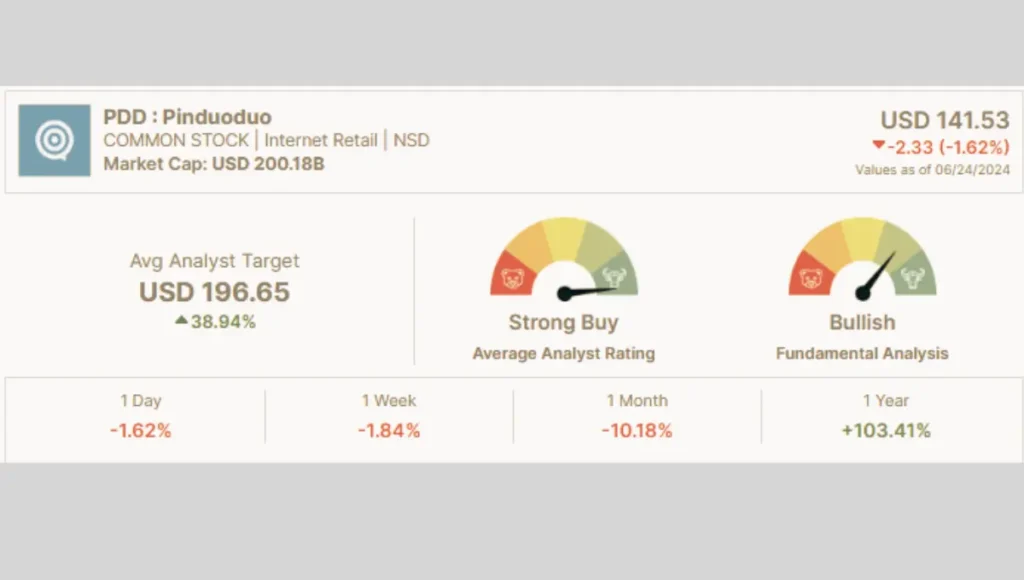

Temu is not open to direct investment. However, because PDD Holdings is a publicly traded corporation, you can buy its shares like any other stock.

PDD is a Chinese corporation, yet it trades on the Nasdaq stock exchange under the stock symbol PDD. Using your brokerage platform, you can buy a stock by searching for that ticker and selecting the buy option.

It’s important to note that Temu’s results are not currently broken down individually by PDD. Despite being considered considerably smaller than Pandodo, Temu has helped the PDD expand rapidly since its inception. In Q4 2023, PDD revenue more than doubled, and it increased in each of the next four quarters of 2023.

As Temu expands, PDD may provide additional information about it, such as earnings, and investors will likely become aware of Temu’s profit potential. Investors have found PDD to be a profitable stock. While Temu is not a pure play for investors, those interested in Temu should buy PDD and gain exposure to Pindodo, which has seen explosive growth on both the top and bottom lines.

Main Competitors of Temu stock

Before making any investment decision in the e-commerce sector, it is important to consider Timo’s key competitors.

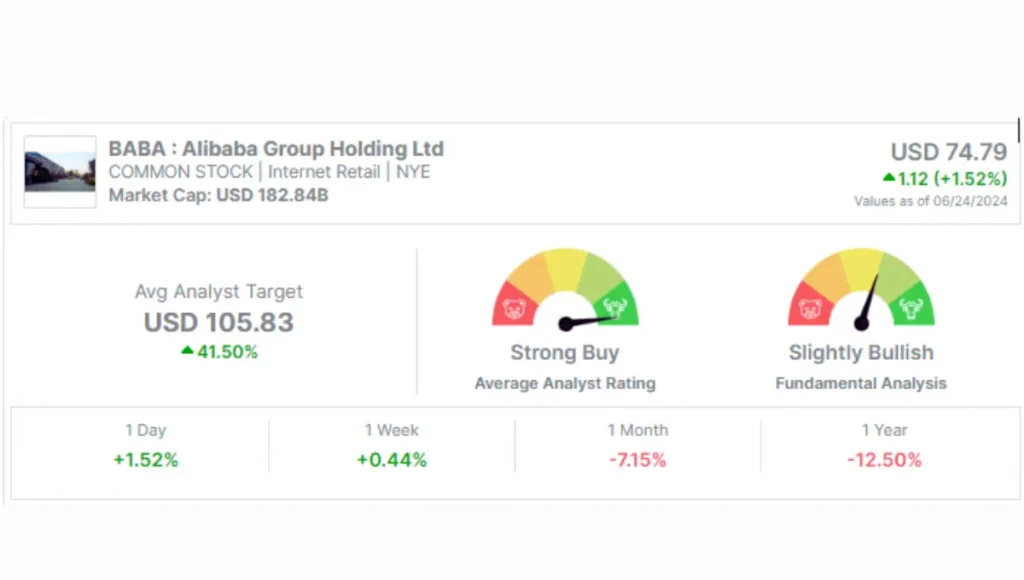

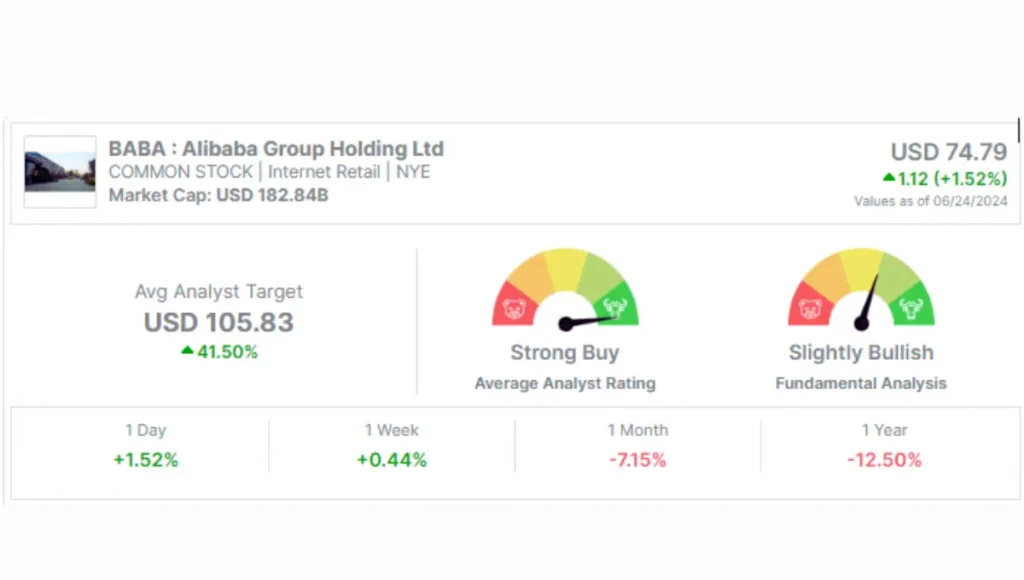

1. Alibaba (BABA: NYSE)

Alibaba, a major force in the global e-commerce industry, competes directly with Temu by offering a wide array of products at competitive prices. Alibaba’s powerful supply chain, solid vendor relationships, and extensive customer base in Asia and other regions make it a strong contender. Its well-established market presence and ongoing innovations in e-commerce and technology are key challenges for Temu’s expansion efforts.

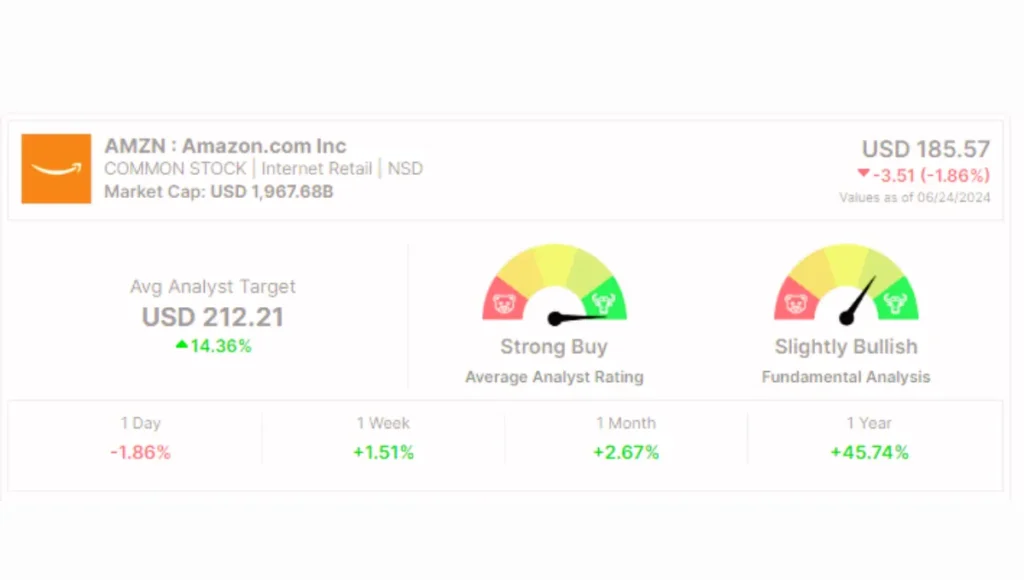

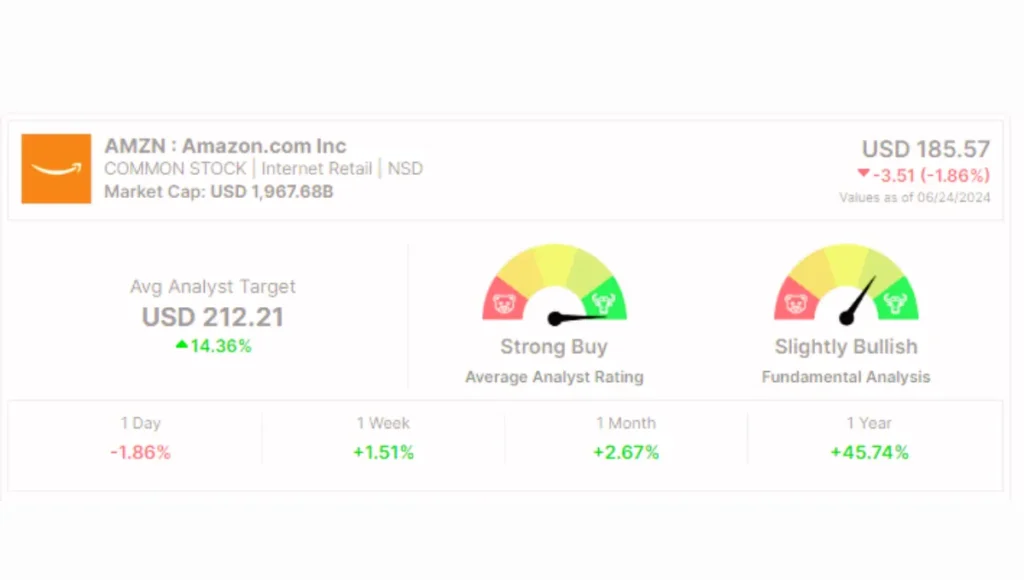

2. Amazon (Amazon: NYSD)

Amazon, a major player in the e-commerce industry, is one of Temu’s primary competitors. With its wide selection of products, innovative logistics, and exceptional customer service, Amazon has set a high standard in online retail. Its ability to offer fast delivery, including same-day and next-day delivery, creates considerable competitive pressure for new entrants like Temu.

Risk and Considerations for Investors in Temu Stock

Temu succeeds in the highly competitive grocery delivery and e-commerce markets. It stands out due to its strong brand visibility, competitive pricing, and efficient logistics network. Additionally, Temu uses its strong relationship with Pinduoduo, a leading e-commerce platform in China.

Temu has huge potential to capitalize on the growing trend of online grocery shopping and the growing urban population in China and other emerging markets. Additionally, Timo is investing in new technologies and expanding into new markets to fuel future growth.

When investing in Temu stock, consider these important factors:

- Risk tolerance: An investment in Temu stock carries significant risk due to the company’s early-stage growth and the competitive market in which it operates.

- Investment goals: Investors should evaluate their investment objectives and financial circumstances before deciding to invest in Temu stock. Given that Temu stock is aimed at long-term growth, investors should be prepared to hold their holdings for several years to fully benefit from its potential.

- Financial performance: Investors should carefully evaluate both Temu’s financial performance and the overall financial health of the industry before making any investment decision.

Conclusion: Investing in Temu stock

Investing in Temu stock presents an important opportunity for both stock investors and financial analysts. Temu has a strong business model, an expanding target market, and a competitive edge, setting it up for future prosperity. By using the steps outlined in this guide, you can navigate the investment process with confidence. Remember to make informed choices, factor in risks, and stay updated on market trends to optimize your investment strategy effectively.

Who owns Temu FAQ?

Is Temu a Chinese company?

Temu shares cannot be purchased directly. After all, PDD Holdings, a Chinese global trading conglomerate, is the parent company of the company and is where you can invest in the business. Under the stock ticker PDD, the corporation is traded on the Nasdaq platform.

Who is the CEO of Temu?

Holdings owns shares of PDD Timo. In September 2022, the global trading giant Chinese Corporation introduced Temu. Apart from Timo, PDD Holdings also owns Pinduoduo, a popular e-commerce platform in China.

Is Temu privately owned?

Yes, Temu is privately owned.

Is Temu listed on the stock market?

Temu is not listed on any stock exchange. After all, PDD Holdings, its parent firm, is listed on public exchanges. With the stock ticker PDD, it is traded on the Nasdaq exchange.