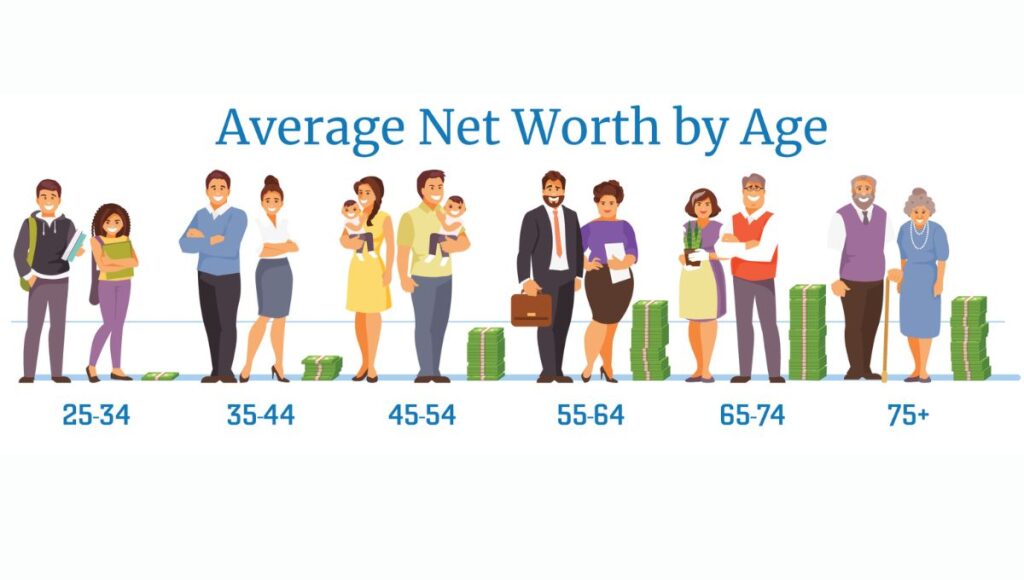

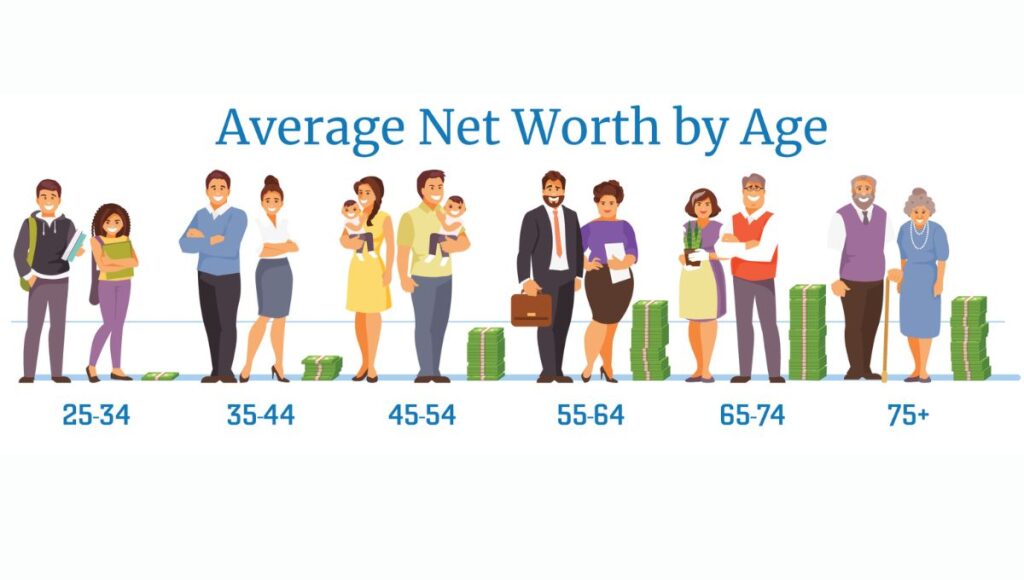

Average net worth of a 50-75-year-old couple: Despite advisors suggesting that Americans should have at least $1 million saved for retirement, most people fall short of this goal. A big reason for this is that many Americans live paycheck to paycheck, making it difficult to save the recommended 10% to 20% of their income for the future.

The sooner you start the habit of “paying yourself first” by putting money into savings before paying your bills, the better your chances of accumulating a substantial nest egg over time. Let’s explore the average net worth of Americans aged 65 to 74 and offer some tips on how you can increase your chances of enjoying a comfortable retirement.

What is the average net worth for retirees?

The Federal Reserve reports that the median net worth of Americans between the ages of 65 and 74 is $409,900. For those 75 and older, it’s $335,600. This makes sense because older retirees typically spend more than they earn and gradually use up their retirement savings as they age.

However, the average net worth for these age groups is much higher due to a few extremely wealthy individuals skewing the numbers. For people aged 65 to 74, the average net worth is $1,794,600, which is more than four times the median. For those aged 75 and older, the average net worth is $1,624,100, nearly five times the median.

Is that a sufficient amount?

While $409,900 might seem like a solid retirement fund—and it could be, if you live modestly in a low-cost area—it may not generate the kind of retirement income many Americans hope for. Investing that amount at a 5% interest rate, which is roughly what you can get from Treasury bills and high-yield savings accounts, would only yield $20,495 per year.

Although Social Security can supplement this, you’ll probably still fall short. Most financial advisors recommend that you need at least 80% of your pre-retirement income to live comfortably in retirement. Given that the median household income in the U.S. is $70,300, this means the average American would need at least $56,240 annually.

“The above average net worth for a 50-year-old is calculated.”

Let’s start by looking at the typical retirement savings plan for Americans. We’re going to zoom in on the straightforward 401K system we have here. In this system, individuals can put away up to $19,500 of their income before taxes each year, as of 2021. Usually, this maximum contribution increases by around $500 every couple of years.

This guideline can give a rough idea for those in Canada with the RRSP plan, as well as for retirement plans in Europe and Australia. Essentially, any country with a tax-deferred retirement plan, a social safety net for retirees, and a GDP per capita of $30,000 or more, can use this chart as a benchmark. It’s important to note that we’re talking about someone who’s considered “above average” in terms of financial resources.

Guide to Maximizing Your 401(k) Savings by Age 50

| Age | Years Worked | Older Savers or Middle Age Savers | Younger Savers or High-End Savers |

| 22 | 0 | $0 | $0 |

| 23 | 1 | $5,000 | $10,000 |

| 24 | 2 | $15,000 | $38,000 |

| 25 | 3 | $30,000 | $60,000 |

| 27 | 5 | $50,000 | $120,000 |

| 30 | 8 | $100,000 | $200,000 |

| 35 | 13 | $150,000 | $350,000 |

| 40 | 18 | $200,000 | $550,000 |

| 45 | 23 | $300,000 | $800,000 |

| 50 | 28 | $500,000 | $1,200,000 |

| 55 | 33 | $650,000 | $1,800,000 |

| 60 | 38 | $800,000 | $2,500,000 |

| 65 | 43 | $1,000,000 | $3,500,000 |

How to Improve Your Chances for an Enjoyable Retirement

To make your retirement more enjoyable, you should think of Social Security as a supplement, not your main source of income. This is because, for most Americans, Social Security alone doesn’t provide enough money to live comfortably. As of May 2024, the average Social Security check for retired workers was just $1,915.26 per month, which adds up to $22,983.12 per year. For many people, that’s simply not enough.

That’s why it’s crucial to invest, and the earlier you start, the better. For instance, using Dave Ramsey’s investment calculator, if you start saving $190 a month at age 20, by the time you’re 65, you could have over $1 million, assuming an average annual return of 8%.

It’s always smarter to focus on increasing your income, savings, and investments before you retire, rather than cutting your expenses later. That’s why it’s crucial to save as much as possible and make use of retirement accounts like 401(k) plans. These accounts offer tax benefits and potential “free money” through employer matching contributions.

A helpful strategy is to automate your savings. This way, you don’t have to remember to contribute to your savings and investment plans each month. By setting up automatic contributions, you can steadily build a bigger nest egg over time. Plus, you’ll benefit from market downturns by buying shares at lower prices, which can enhance your long-term gains.

Another way to grow your savings is to avoid being overly cautious, especially when you’re younger. In your 20s, 30s, and 40s, you have plenty of time before retirement to weather market downturns, and contributing more during this period can lead to significant long-term gains. If your investments are too conservative, you might not see a net positive return after accounting for inflation and taxes.

What percentage of retirees have a net worth of over $1 million?

When looking at the financial status of retirees, a significant number have managed to accumulate considerable wealth. Around 10% of retirees boast a net worth exceeding $1 million. This reflects a portion of the retired population that has successfully built substantial financial reserves, often through a combination of savings, investments, and possibly other assets. This level of net worth can provide a comfortable retirement, offering more financial freedom and security.

What is considered wealthy in retirement?

What’s seen as being well-off during retirement? Well, it’s all about having enough money to cover your needs and then some, without worrying too much about bills or unexpected expenses. Think of having a comfortable home, being able to travel, pursuing hobbies, and maybe even helping out your family or donating to causes you care about. It’s about having financial freedom and security to enjoy life without stress.

Financial Samurai Post-Tax Savings Guide

| Age | Years Worked | Older Savers or Middle Age Savers | Younger Savers or High End |

| 22 | 0 | $0 | $0 |

| 23 | 1 | $5,000 | $10,000 |

| 24 | 2 | $15,000 | $38,000 |

| 25 | 3 | $30,000 | $60,000 |

| 27 | 5 | $50,000 | $120,000 |

| 30 | 8 | $100,000 | $200,000 |

| 35 | 13 | $150,000 | $350,000 |

| 40 | 18 | $200,000 | $550,000 |

| 45 | 23 | $300,000 | $800,000 |

| 50 | 28 | $500,000 | $1,200,000 |

| 55 | 33 | $650,000 | $1,800,000 |

| 60 | 38 | $800,000 | $2,500,000 |

| 65 | 43 | $1,000,000 | $3,500,000 |

| 70 | 46 | $1,200,000 | $3,700,000 |

| 75 | 50 | $1,500,000 | $4,100,000 |

The chart is based on the idea that if you save $5,000 to $15,000 a year after paying taxes, you can see some significant growth in your savings. It assumes you’re putting this money into a retirement account where you don’t have to pay taxes on it until later. I kept things simple, ignoring things like inflation and investment returns. For many people who earn over $85,000 a year, saving this amount annually should be quite doable, and for some, even easy. The chart aims to demonstrate how steadily saving can add up over time.

Home Equity Accumulation Guide By 50-75

Let’s create a chart that shows the value of something, like maybe your overall financial worth, ranging from $250,000 to $500,000. One thing we’ll assume is that by the time you retire, you’ve paid off your house, so you can count that as part of your total worth.

| Age | Years Owned | Equity Build Progress (Low) | Equity Build Progress (High) |

| 28 | 1 | $3,500 | $7,500 |

| 30 | 3 | $12,000 | $23,000 |

| 35 | 5 | $20,000 | $40,000 |

| 40 | 10 | $45,000 | $95,000 |

| 45 | 15 | $85,000 | $150,000 |

| 50 | 20 | $110,000 | $215,000 |

| 55 | 25 | $150,000 | $300,000 |

| 60 | 30 | $190,000 | $390,000 |

| 65+ | 35 | $250,000 | $500,000 |

Let’s say a person who’s doing a bit better than average buys a property worth between $250,000 and $500,000 when they’re 27. By the time they hit 28, they’ll have owned the place for about a year and paid off anywhere from $3,500 to $7,500 of the loan amount, which typically ranges from $250,000 to $400,000.

Now, for a more cautious estimate, let’s imagine they got a $250,000 loan without putting any money down for the cheaper house. But keep in mind, even if they’re just a bit above average, after working for about 5 years, they should have socked away somewhere between $25,000 and $30,000 in savings, according to those charts showing after-tax savings.

When you finally finish paying off your mortgage after 30 years at the age of 27, you’ll be 57 years old. At that point, you’ll have a home to call your own, which means you won’t have to worry about paying rent for the rest of your life. Meanwhile, if someone is above average and manages to pay off their house in their 50s, they’re in good shape too.

The real value of your property lies in the money you save on rent for the rest of your life. You can calculate this value by figuring out how much you’d pay in rent over the years and then taking its present value. Or, you could simply consider the market value of your home. To keep things conservative, let’s assume that your home’s value doesn’t increase over time and that you don’t make any extra payments to speed up the mortgage payoff.

Over the years, home prices tend to increase slightly more than the rate of inflation, usually around 2-3% annually. But when you consider that most people make a down payment of around 20%, those modest returns translate into a much higher percentage in terms of the cash they’ve invested. It could be as high as 10-15% cash-on-cash return each year.

Comparatively, this return is quite favorable when you look at the average return of around 8% from the S&P 500. Plus, there are added perks like tax benefits from deducting mortgage interest, which makes owning a home through a mortgage especially advantageous for those with higher incomes.

You’ve got it! I’ll remember “Take the First Step” for you.

While it’s interesting to compare your retirement savings with national averages, what matters is how your finances are doing. Depending on your lifestyle and how long you expect to live, $409,900 might be more than enough for retirement or far from sufficient.

Meeting with a financial planner can be a good start to creating a plan that suits your long-term needs and matches your risk tolerance. Whether you consult a professional or manage everything yourself, automating investments, utilizing retirement plans, and starting early are all important steps in planning for retirement.