SoFi Bank’s innovative dual banking approach combines checking and savings accounts, both of which earn remarkable interest rates. Along with these high APYs, SoFi members enjoy many related benefits, such as rewards redeemable for cash, fractional investment shares, statement credits, and loan repayments.

This comprehensive review explains the mechanics of this comprehensive account, its specific banking features, and the various online ways to access funds, helping you determine if SoFi Checking & Savings is right for your financial needs.

Sofi High Yield Checking and Savings

| Open Account for SoFi Checking and Savings | Ratings Methodology |

| Rates as of June 9, 2024 | Award Icon: 2024 AWARD WINNER |

| SoFi Checking and Savings | Rating: 4.50 out of 5 stars |

| OFFER ALERT | New customers are eligible to receive up to a $300 bonus when they set up qualifying direct deposits! |

| APY | up to 4.60% |

| MIN. TO EARN APY | $0 |

PROS/CONS of the Sofi High Yield Checking and Savings

Pros

- Competitive APY on both Savings and Checking

- No account fees

- Get a welcome bonus of up to $300 when you sign up and set up direct deposit.

- Early access to direct deposits

- Tools to help you track savings goals

- Unlimited external transfers (within daily transaction limits)

- ATM access

- FDIC insured (up to $2 million with opt-in to SoFi Insured Deposit Program)

Cons

- Combo account only; no standalone savings or checking

- Maximum Savings APY requires direct deposit

- Overdraft protection requires a monthly direct deposit minimum

- No branch access; online only

Bottom Line of Sofi High Yield Checking and Savings

For those planning direct deposits, Sofi High Yield Checking and Savings is a great option. This account comes with a high annual percentage yield (APY), and the linked checking account also earns a rate that’s better than most. Plus, there’s a chance to earn a bonus of up to $300, along with a range of additional perks and features. This is a considerable combination for a banking relationship switch.

Compare savings rates of other Banks

Make sure you choose the best savings account by comparing interest rates and promotions. Here are some high-yield savings accounts to consider.

| Account | APY | Promotion | Min. Earn | Ratings |

| SoFi Checking and Savings | up to 4.60% | New customers can earn up to a $300 bonus with qualifying direct deposits! | $0 | 4.50/5 |

| Citizens Access® Savings | 4.50% | N/A | $0.01 | 4.00/5 |

| CIT Platinum Savings | 5.00% APY | N/A | To get the highest interest rate on your account, you need to open it with $100. But to enjoy the maximum annual percentage yield (APY), you need to deposit at least $5,000. | 4.50/5 |

What is SoFi Bank?

SoFi is a large financial company and online bank that offers a variety of services, such as mortgages, personal loans, credit cards, investment accounts, and personal banking. Their high yield checking and savings accounts come with competitive interest rates, making them attractive to customers.

Sofi High Yield Checking and Savings Interest Rate

| Account | APY | Minimum Deposit |

| SoFi Checking and Savings (Savings) | up to 4.60% | $0 |

Data Source: SoFi. The higher-tier APY on the savings portion is competitive with top high yield accounts but requires setting up direct deposits or maintaining $5,000 every 30 days to avoid a lower rate.

We gave it a shot. The firsthand experience of our team

At The Ascent, we often use the products we review. For example, one of our developers, Liz Wilson, uses a SoFi checking and savings account.

Liz’s Review 2024

I chose an online bank for its higher annual percentage yields (APYs) than traditional banks. In particular, I chose SoFi because of its competitive rates and positive reviews. The transfer process is smooth, and the app is easy to use. However, when I first deposited a check, my account was temporarily locked due to an unrecognized issuer, which was frustrating to resolve.

Full Sofi High Yield Checking and Savings Review 2024

These are the pros and cons of registering for a SoFi checking and savings account.

Top Benefits: Sofi High Yield Checking and Savings

| Feature | Details |

| Competitive APY | Up to 4.60% on savings, 0.50% on checking |

| Welcome Offer | Up to $300 cash bonus with qualifying deposits |

| No Fees | No monthly maintenance or overdraft fees, and free withdrawals at Allpoint ATMs |

| Early Access | Get your direct deposit up to two days early. |

| Savings Tools | Vaults for specific savings goals, and round-ups for automatic saving |

| FDIC Insured | You can safely deposit up to $2 million with the SoFi Insured Deposit Program. |

What could be made better?

- No Standalone Products: accounts are bundled.

- Cash Bonus Requirements: High direct deposit thresholds for maximum bonus.

- Overdraft Protection Requirements: Monthly direct deposits of $1,000 are needed.

- No Local Branches: limited to online banking and support.

- Fee for Cash Deposits: Up to $4.95 at GreenDot locations.

How Do You Access Your Money?

SoFi, despite being an online-only service, offers several fee-free options for depositing and withdrawing funds.

Deposit Options for Sofi High Yield Checking and Savings Accounts

| Deposit Method | Description | Availability of Funds | Fees |

| Electronic bank transfer | Transfer funds from a linked bank account | 1–5 business days | None |

| Direct deposit | Have your paycheck or other payments directly deposited into your account | 1–5 business days | None |

| Mobile check deposit | Use the SoFi app to deposit checks by taking a photo | 1–5 business days | None |

| At GreenDot partner retail locations | Deposit cash at participating local retailers through GreenDot | 1–5 business days | Up to $4.95 per transaction |

| Transfer between SoFi accounts | Move funds between your SoFi Checking and Savings accounts via your online account | Immediate | No |

You have the flexibility to transfer money between your SoFi checking and savings accounts whenever you want to use your online account. While Allpoint ATMs do not accept cash deposits, you can make cash deposits at participating local retailers through SoFi’s partnership with GreenDot. Note that in-person cash deposits may incur a service fee of up to $4.95 per transaction. Deposited funds are usually available within one to five business days.

Withdrawal Options for Sofi High Yield Checking and Savings Accounts

| Withdrawal Options | Details |

| Electronic Bank Transfer | Transfer funds electronically to another bank account. |

| Physical Checks | Request and use paper checks provided by SoFi at no cost. |

| ATM Withdrawals | Withdraw cash from ATMs; there are no fees at Allpoint ATMs. |

| Peer-to-Peer Transfers | Transfer money to peers using SoFi’s platform |

| Online Bill Pay | Pay bills directly from your SoFi account |

| Out-of-Network ATM Use | There is no SoFi fee, but the ATM operator may charge a fee. |

| Daily ATM Withdrawal Limit | Up to $1,000 per day. |

| Daily Debit Card Use Limit | Up to $6,000 per day. |

SoFi imposes a daily limit of $1,000 on ATM withdrawals and $6,000 on debit card transactions. A paper test may be requested if required.

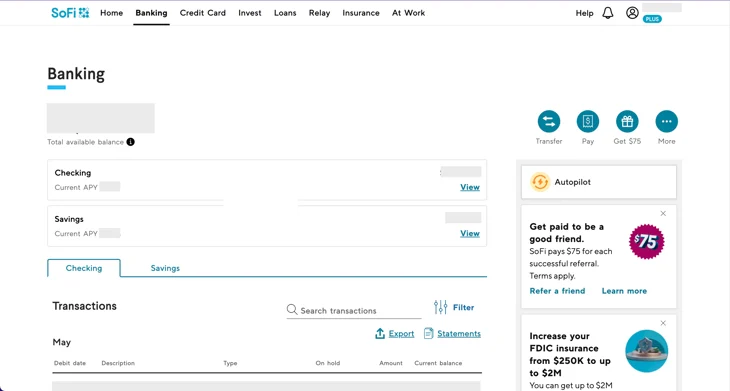

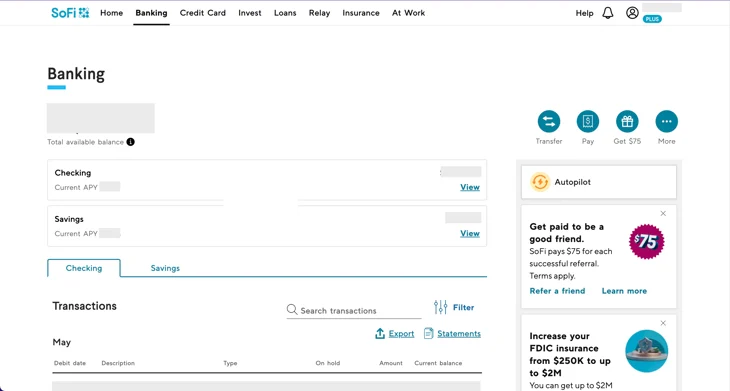

How the Sofi High Yield Checking and Savings Platform Appears:

SoFi Checking and Savings Platform. Photo credit: Liz Wilson

Does SoFi Bank offer safe deposits?

Yes, SoFi accounts are protected by FDIC insurance, which means each depositor is covered up to $250,000. With the SoFi FDIC Insurance Network, this coverage can potentially increase to $2 million.

SoFi Customer Service and Experience

| Support Option | Availability |

| Phone Support | Monday to Thursday: 5 a.m. to 7 p.m. PT Friday to Sunday: 5 a.m. to 5 p.m. PT |

| Chat Support | Available during support hours |

| @SoFiSupport |

SoFi Relationship Benefits

SoFi members gain access to several perks, including:

- SoFi member rewards

- Loan product rate discounts

- 15% off estate planning services

- Referral bonuses

- Free financial planning

- Exclusive events and experiences

- Access to a members-only Facebook community

- Member lounge access at SoFi Stadium

Is Sofi High Yield Checking and Savings Right for You?

If you’re looking for a bank account that combines checking and savings with good interest rates, SoFi Checking and Savings is a great choice. It’s perfect for people who like banking online and want the convenience of managing their money digitally.

Other Products by SoFi

| Product | Description |

| SoFi Unlimited 2% Credit Card | A credit card offering unlimited 2% cash back. |

| SoFi Mortgage | Mortgage services, including refinancing and cash-out refinancing. |

| SoFi Personal Loans | SoFi offers various choices for personal loans. |

| SoFi Active Investing | Services for active investing in financial markets. |

| SoFi Automated Investing | Automated investment services are offered by SoFi. |

SoFi also provides a wide array of products and services, including:

- Mortgage Refinancing

- Cash-out refinancing

- Jumbo loans

- Home equity loans

- Credit card

- Personal loans

- Investment and retirement accounts and services

- Proprietary ETFs

- Life insurance

- Homeowners Insurance

- Auto insurance

- Renters Insurance

- Estate planning

- Small business financing

Keep Reading About SoFi Bank

Explore more about SoFi’s offerings, including detailed reviews and promotional information.

Our Savings Account Methodology

We rate savings accounts on a scale of one to five stars, with one being poor and five being excellent. We evaluate savings accounts based on four key factors: annual percentage yield (APY), brand reputation, fees and minimum requirements, and additional perks that can enhance the account, such as ATM access, linked checking access to accounts, or branches.

Our scoring system assigns weights to each criterion as follows:

- APY: 50%

- Brand and reputation: 20%

- Fees and minimum requirements: 15%

- Other perks: 15%

FAQ: Sofi High Yield Checking and Savings

Is SoFi Bank a real financial institution?

SoFi Bank is a fully licensed and regulated financial institution operating under the supervision of the relevant authorities. It offers a range of banking services, including savings accounts, loans, and investment products, making it a dominant player in the financial industry.

Does a debit card come with SoFi’s checking account?

Yes, you receive a debit card when you open a checking account with SoFi.

Does SoFi charge a monthly fee?

No, SoFi Checking and Savings will not subject you to monthly maintenance fees, minimum account fees, or overdraft fees.

What ATMs can you use with SoFi?

Feel free to use any of the 55,000 ATMs in the AllPoint network at no charge. These ATMs are conveniently located at various retail stores, such as Target, CVS, Costco, and Speedway. Just keep in mind that if you decide to use an ATM that’s not part of the network, you’ll be responsible for any fees, and we won’t cover them.

Conclusion: offer by SoFi Checking and Savings

SoFi Bank’s Checking & Savings Account offers a competitive interest rate of up to 4.60% APY with no monthly fees. You can earn up to a $300 bonus with qualifying direct deposits. Although it’s online only and requires direct deposit for the maximum savings APY, it offers early access to funds and FDIC insurance coverage of up to $2 million. If you are satisfied with online banking and want to maximize your savings, consider this.